Outsourced Cfo Services Things To Know Before You Buy

All About Vancouver Accounting Firm

Table of ContentsThe smart Trick of Small Business Accountant Vancouver That Nobody is Talking AboutThe Only Guide for Tax Accountant In Vancouver, BcSome Ideas on Vancouver Tax Accounting Company You Need To KnowVancouver Tax Accounting Company - QuestionsUnknown Facts About Outsourced Cfo ServicesThe Small Business Accounting Service In Vancouver Statements

Below are some benefits to working with an accounting professional over an accountant: An accountant can provide you a detailed view of your service's financial state, together with techniques and referrals for making economic decisions. Meanwhile, accountants are just accountable for tape-recording monetary deals. Accounting professionals are called for to complete more schooling, qualifications and work experience than bookkeepers.

It can be tough to gauge the ideal time to hire an accounting professional or bookkeeper or to establish if you require one at all. While many local business work with an accounting professional as a professional, you have several choices for handling economic jobs. Some tiny business owners do their very own accounting on software program their accounting professional suggests or utilizes, providing it to the accountant on a weekly, monthly or quarterly basis for activity.

It might take some background research study to find an appropriate accountant due to the fact that, unlike accountants, they are not needed to hold a specialist accreditation. A strong endorsement from a trusted associate or years of experience are very important aspects when hiring a bookkeeper. Are you still not exactly sure if you need to hire a person to assist with your books? Right here are 3 circumstances that show it's time to employ an economic specialist: If your tax obligations have ended up being as well intricate to take care of on your own, with multiple income streams, foreign investments, a number of deductions or various other considerations, it's time to employ an accountant.

The Buzz on Vancouver Tax Accounting Company

For local business, proficient cash monitoring is an essential element of survival and growth, so it's a good idea to collaborate with an economic expert from the beginning. If you like to go it alone, think about starting out with bookkeeping software application and keeping your books thoroughly approximately day. By doing this, ought to you require to work with a specialist down the line, they will certainly have exposure into the full financial background of your company.

Some resource meetings were performed for a previous variation of this post.

Not known Facts About Vancouver Tax Accounting Company

When it comes to the ins and outs of taxes, accounting and financing, nonetheless, it never ever injures to have a knowledgeable professional to count on for support. A growing variety of accountants are likewise taking care of points such as capital forecasts, invoicing as well as human resources. Eventually, a lot of them are handling CFO-like functions.

Local business proprietors can anticipate their accounting professionals to aid with: Choosing the service structure that's right for you is necessary. It affects just how much you pay in tax obligations, the documents you need to file as well as your individual liability. If you're aiming to transform to a different business structure, it could cause tax obligation effects and other complications.

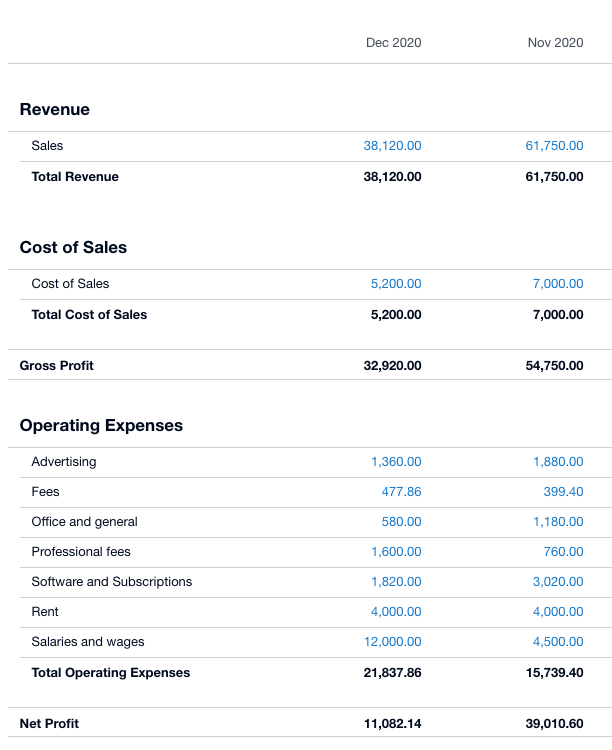

Also business that are the exact same dimension as well as industry pay very various amounts for bookkeeping. Prior to we get involved in buck numbers, let's talk concerning the expenses that go right into small company accountancy. Overhead expenses are prices that do not directly become a profit. These costs do not convert into cash money, they are necessary for running your business.

Getting The Tax Consultant Vancouver To Work

The ordinary price of audit services for local business differs for each distinct scenario. However given that bookkeepers do less-involved jobs, their rates are often more affordable than accountants. Your economic service charge relies on the job you need to be done. The average monthly accounting fees for a small company will rise as you add more solutions as well as the jobs get tougher.

You can tape-record deals and process pay-roll using on the internet software. Software services come in all Vancouver tax accounting company shapes and also sizes.

The Ultimate Guide To Vancouver Accounting Firm

If you're a brand-new business proprietor, don't fail to remember to aspect accountancy expenses into your budget plan. If you're a professional proprietor, it may be time to re-evaluate bookkeeping prices. Administrative expenses as well as accountant costs aren't the only bookkeeping expenditures. virtual CFO in Vancouver. You need to additionally think about the results bookkeeping will have on you and also your time.

Your ability to lead workers, offer clients, and also choose could endure. Your time is also valuable as well as ought to be taken into consideration when looking at audit prices. The time invested in bookkeeping jobs does not produce profit. The less time you invest on bookkeeping and taxes, the more time you need to expand your company.

This is not planned as lawful recommendations; for more details, please click here..

The Basic Principles Of Vancouver Tax Accounting Company